A Mobile Beauty Therapists’ Guide to Money Management

By Zoe Greenwood, August 25 2020

Tax and money are one of the most tricky topics to get your head around. It’s one that can often slip to the bottom of the list while you’re out doing what you love. When we spoke to our Salonettes, we found that it was one of the areas of running a mobile beauty business that they found the most challenging. That’s why we decided to create this guide, so you have everything you’ll ever need to know about money and tax in one place.

Why Money Management Is Important

No matter what job role you’re in, money management is a critical skill that every adult should have. It helps you stay on top of your bills, understand where your money is going (e.g. how much you spend on food, travel and general items) and can even help you save money for the future – we’re talking about holidays, a house or your pension.

Money management is especially important when paying your tax bill as you’ll need to show evidence of your current income, along with any expenses that you want to deduct. That’s why we recommend making a note of what you earn and spend, with all of your invoices and receipts so that you have everything you need. Remember, HMRC can request evidence of your income and expenses up to 22 months.

The first step of taking control of your finances is to create a budget. This will help understand what’s coming in and out of your account and also means you’re less likely to get caught out by unexpected costs.

We have partnered with TaxScouts to make tax-worry a thing of the past for our Salonettes. They handle all of the tax reporting for you through an easy to use online portal. What’s even better is that we have secured a 5% discount for LeSalon therapists, meaning that you have to pay just £113 to never have to stress about Self-Assessment again. Click here for more information.

Things To Consider About Being Self Employed

When you’re self-employed, it’s really important to get your taxes sorted as soon as you can. But what does that mean?

There are a few things to bear in mind when it comes to your taxes:

- You need to register as self-employed – you have to declare your self-employed income to HMRC by completing what’s known as a Self Assessment:

- Do this yourself via HMRC

- Pay an accountant to help

- Use an alternative provider to sort your taxes for you

- The Tax Year – the tax year runs from 6th April to 5th April and your tax bill will be calculated based on your earnings and expenses during this period.

- Track your income and expenses – it’s really important to calculate your tax bill accurately to avoid being fined (and general stress about your taxes!). The best way to do this is to keep a well-organised record of everything that you earn and spend for your business from start to finish of the tax year. Be aware that HMRC can request evidence of anything from your tax return up to 22 months after you’ve paid.

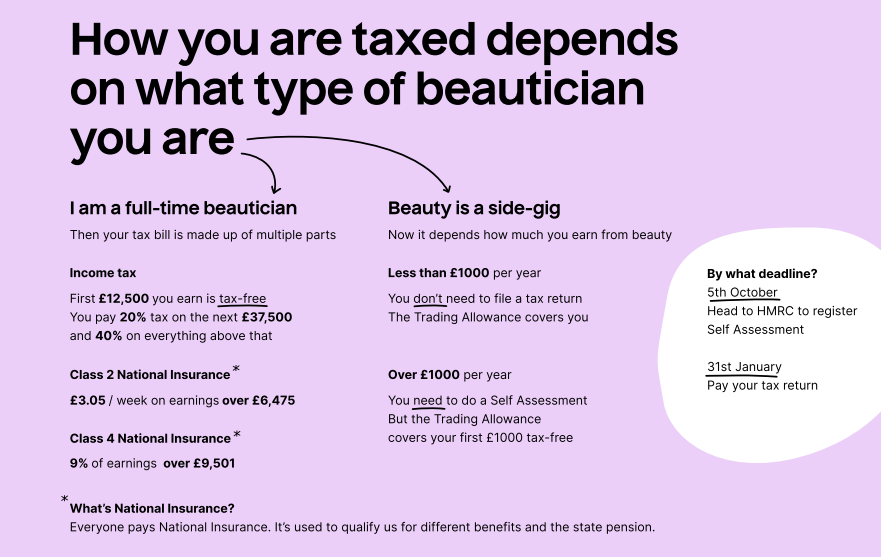

- Your tax bill – as part of the self-employed workforce, you have to pay Income Tax and two types of National Insurance. Click the links below for a jargon-free explanation of what they mean:

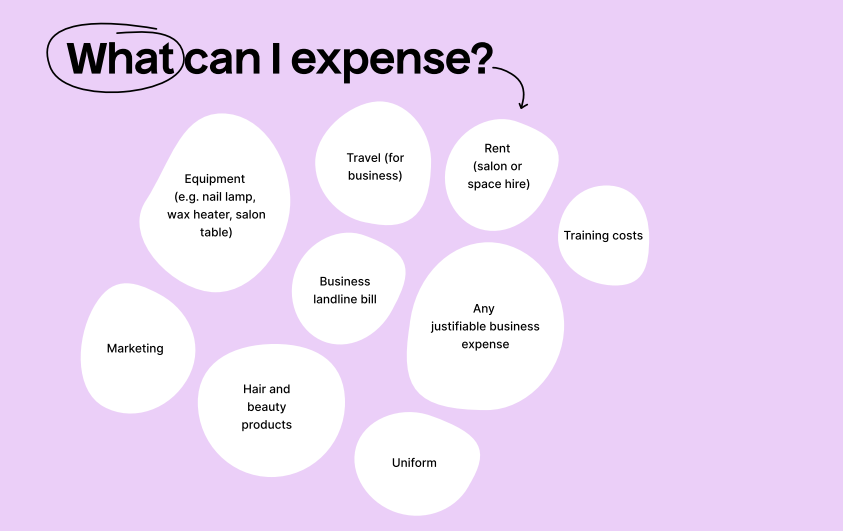

Expenses: What Can You Expense

You can expense most things that are a direct expense to the running of your business and solely for your business. They need to be easily justifiable to HMRC so make sure that you don’t include anything that is for personal use. Some of the biggest expenses that you are likely to incur are equipment such as nail polish and travel such as mileage and public transport.

Take a look at this infographic from TaxScouts which outlines some of the expenses you might incur:

Earnings: What Do You Need To Declare

You need to declare all of your income, as long as it is more than £1,000 per year. Remember that you also need to declare any payments that you receive in cash. This can include earnings from other sources outside of the mobile beauty work that you do such as other jobs or earning from other businesses that you own. How you get taxed will depend on how much you earn.

How To Track Your Finances

There are people who haven’t looked at their bank statements in months; others constantly check them. Whether you’re planning for the future, want to spend less money, or need a clear overview of your expenses for tax purposes, tracking your finances is key. And, let’s be honest, it’s pretty great to know what’s regularly coming in and out of your bank account.

Learning how to track your finances is easy, but making sure you stay on top of it is harder. Fortunately, there’s various ways you can do this – either through a spreadsheet, app or using a separate bank account. Here we’ll talk about the different ways so that you can make an informed decision.

Spreadsheet vs App: Which one is better?

One of the most popular ways of tracking expenses is through an excel spreadsheet. It helps you get a clear overview on your spending and where you might be over-spending in some categories. You’ll also find that this will help you save more money in the long run. There’s a number of free excel templates available, where you can customise it to your own expenses and have the math done for you. The most difficult part of using a spreadsheet is that you’ll have to constantly remember to go back to your computer and update it.

Apps, on the other hand, are always with you because they’re on your phone. Many people prefer using an app to control their finances as they can track the expenses the moment they occur. The convenience of an app means that your budget might also be more precise.

Quickbooks helps self-employed people keep track of their income and expenses. It lets you track miles, add receipts, create invoices and – even better, automatically separates your personal expenses from business expenses. All you have to do is enter the information in and it will be able to categorise the different expenses.

Separate Bank Account

To make tracking your expenses and revenues easier, it is recommended to have a separate bank account for your mobile beauty business. By having all of the money coming in and out related to your business in one place will make management much easier. You can then transfer money to your personal account for personal spending.

This is a common solution for many people as, once the expenses have been made, they know what they have left to spend (or save!) without risking not having enough money to pay off their bills. The downside, however, is that you’ll have to keep on top of your bills and expenses in general, and update when necessary, in case you incur any changes. If you don’t keep an eye on it you might end up going into an overdraft

Do I need to keep receipts?

It’s always a good idea to keep receipts and invoices. Not only will it give you an accurate view of your finances, but it simplifies the process of submitting your tax return. It’s also good to have on hand in case HMRC ever makes an enquiry about your taxes.

There are so many different types of records that it’s hard to understand what type of receipts you need to keep track of.

The following are what you should hold on to:

- Bank statements

- Expenses related to your business (including travel)

- VAT records (if applicable)

- Records of your personal income and invoices

Fortunately, you don’t have to keep paper receipts – digital versions are completely fine (and a lot easier to store). Many apps will have the option to store receipts, or you can create a folder that holds all of them.

How do I track mileage?

If you use your personal car for business purposes, it’s super important to track your mileage. If you don’t keep these records in the right way, you can’t include these expenses on your business taxes.

To keep track of your mileage for tax purposes, you’ll need:

- Your mileage

- Dates of your trips

- Where you drove

- The business purpose of your trip

You can either go old school and track it via a logbook where you’ll have to record all the information at the time of the trip; this will include the driving purpose, information about the destination, and when you started and finished driving. The easiest way, however, is to use an app. MileIQ is a great app to automatically track your mileage. It runs in the background and captures your miles, creating a record of each of your drives. You can also separate your trips into personal and business, if you use the same car for both.

In Conclusion

Basically, the most important thing to remember when it comes to your taxes is not to panic. At first, they will seem needlessly complicated but as long as you’re organised, they’re actually pretty simple. Just make sure that you keep a record of all of your business dealings and you’ll be ahead of the game by the tax return deadline!

If you want a professional to help you through your Self-Assessment then we have partnered with TaxScouts who will handle your Self-Assessment for a special price of £113. They kindly given LeSalon Salonettes a 5% discount, which can be claimed here.